Q&A from the Webinar:

Q. You started in 2008 but have no assets prior to March 2020 (COVID). What were you doing from 2008 to 2020?

A. This REIT is our seventh fund since 2008. We have over $275 million in assets under our management.

Q. Does the projected ADR growth signify the return of business travel?

A. That is the reason for a portion of the growth. We have seen more leisure travelers staying at our properties and expect business travel to continue to increase throughout 2023-2025.

Q. Are start- and end-dates already set for the 3-year hold period?

A. We believe we will reach the $50 million capital goal in Q2 2023. That is when the 3-year hold period will begin.

Q. When the fund closes and hotels are sold, what is the expected range of yield to the fund, and the net to investors after the management fees?

A. We are anticipating growth between 25-30% from the sale of the properties in the summer of 2026.

Q. 12% annualized return — does this equate to 12% per month (on average) or 12% per year?

A. The monthly distributions return is 12% per year, equating to an average of 1% per month.

Q. What assets are currently in the REIT?

A. Hilton Doubletree, Charlotte, NC; Marriott Residence Inn, Cape Canaveral, FL; Hilton Garden Inn and Hilton Homewood Suites, Fort Wayne, IN; Hilton Hampton Inn, Fort Myers, FL; Marriott Courtyard and Marriott Residence Inn, Baton Rouge, LA; Marriott Townplace Suites, Metairie, LA; Marriott Aloft, Rogers, AR; Marriott Townplace Suites, Fayetteville, AR; Marriott Fairfield Inn, Jonesboro, AR

Q. What about recession: what are your plans to weather it, and what are the reasons behind those plans?

A. We believe that the REIT will be able to weather any potential recession due to the continued growth of business travel and the fact that service inflation is sticking more than consumer prices, allowing us to charge higher rates than other industries.

Q. How does one get out of the REIT if they want?

A. This investment is considered an illiquid investment and funds will be held with us for the full duration of the investment.

Q. People told me a 12% ROI is a stay away. How long can you sustain the 12%?

A. We are confident we can maintain this return for the foreseeable future and expect it to increase as we add more hotels to the fund.

Q. Who gets the 80% and 60% after the 8% distribution?

A. You are a preferred investor: you make 100% of profits until you receive a minimum of an 8% return on your investment, you receive 80% of profits between 8-12%, and you receive 60% of profits at 12% and above.

Q. How do you fare against your competition?

A. Of the dozen or so publicly traded REITs that our team looked at the highest ROI we found was 7.7%. We are doing quite a bit better than our competitors in the hospitality industry, because we have no legacy assets. We have paid our investors 12.04% ROI.

Q. Is it required for an investor to have an LLC to invest?

A. No, you may invest as an individual, company, or trust.

Q. Does remote work hold any threat to future plans, i.e. falling business travel?

A. Remote work has not negatively affected us as much as you may think. The majority of industries and companies are requiring employees to return to work, and even work-from-home employees need to travel to visit their clients across the country. We don’t believe that remote work will effect business travel in the future, and will be decreasing over the next few years.

Q. Do you have a breakdown % of business travel vs leisure travel?

A. About 75% of all U.S. travel is business related.

Q. What about potential damage to properties from hurricanes, etc.?

A. We own business interruption insurance on all our properties, which pays us 80% of the projected profits when a hotel is damaged and out of business.

Q. Do you acquire any assets with assumable debt?

A. Yes, our Debt to Equity Ratio is 65/35. We put down 35% equity when we purchase a property and the other 65% is debt.

Q. Will investors partake in upside/profit at disposition?

A. Absolutely, we expect you to receive between 25-30% ROI from the sale of the properties after 3 years. That is on top of the 3 years’ worth of distributions we would have already paid you at that time.

Q. Can I reinvest my 1% monthly instead of cashing it out?

A. You can not automatically have your monthly distributions reinvested, but you can manually reinvest as often as you would like to.

Q. Is there a cutoff date to invest in this fund?

A. Not a set date, but we believe it will be during Q2 2023.

Q. Do you have a mobile app to use to track our investments?

A. Yes. KoreConX, our transfer agent, has a mobile app. This is how you can keep track of and manage your investment.

Q. Why select-service, as opposed to full-service/resort? Don’t those hotels have the ability to charge the highest rates?

A. The select-service type of hotel has the best history of recovering from a down hospitality market. They also tend to have higher returns than the motel or resort classifications of hotels due in large part to less overhead expenses.

Q. Can you give me an example of what a good month would look like vs. a bad month?

A. On a good month you can expect to receive 16% annualized return for your monthly distribution, and the lowest monthly distribution we have paid has been 8% annualized.

Q. You mentioned that the fund invests on a Preferred Basis. What percentage of ownership does the fund hold in the properties? Who are the other equity holders in the property?

A. We own 100% of the properties in this REIT. In some of our previous funds we had an institutional investor own a portion of the hotels.

Q. What’s the average occupancy in your portfolio of hotels to achieve the 12%?

A. Occupancy across all hotels is around 70% on average and that is with one hotel closed for renovations (it should be reopening in the beginning of April).

Q. What were the monthly distribution percentages for December 2022 and January 2023?

A. In December, we paid 18% annualized distribution including our end of year bonus distribution. In January, we paid 10% annualized distribution.

Q. Do we, as investors, hold any title in the properties?

A. No, this is considered passive income. You would not be an equity owner of the hotels.

Q. Are you going to add more hotels in this fund?

A. Yes, we are looking to acquire 4-5 more hotels this year.

Q. Will you roll out more hotel funds in the future, separate from this REIT?

A. Yes, we are already beginning the early stages of creating a new, larger fund.

Q. Is the initial 8% a guaranteed return before splitting gains beyond that mark?

A. We cannot guarantee any rate, but that is our minimum target return and we have never returned less than that.

Q. Why are you offering this to the public, rather than institutions where you have a prior relationship?

A. All of our previous funds were exclusive to Goldman Sachs clients. We decided to bring this type of investment to the public and raise funds directly to have a more hands-on relationship with our investors and be able to answer their questions directly, rather than going through a middleman.

Q. Are all distributions paid or reinvested?

A. Distributions must be paid, due to SEC regulations on private REITs.

Q. What are the fees paid to the manager? And, how often are they paid?

A. Phoenix American Hospitality has its own management company. We charge an industry standard 3% fee for running the day to day operations of our hotels each month.

Q. How many folks are on your Management team, and what positions? How many departments manage this total portfolio other than the folks in the hotels?

A. There are 6 members of the management team here in our Dallas headquarters. In total we have 3 departments within Phoenix American Hospitality. The Management team, the Acquisitions team, and the Investment team.

Q. Is the investor personally guaranteeing the loan?

A. No, the investment is protected by the underlying value of the hotels we own.

Q. Do you require a financial statement from the client to invest?

A. No, all you need to participate is to complete our online application.

Q. What happens if you can’t sell the portfolio properties at the 3 year point? Do you have option to retain properties, thereby forcing investors to remain beyond the 3 year point?

A. We have every intention of selling these properties after 3 years. The only reason that we would not is if the hospitality industry is drastically down in three years. If that were to happen, we can legally hold on to the funds for an additional 2 years (while continuing monthly distribution payments) and wait for the hospitality industry to recover, but that is just a safety precaution we added to this investment because of COVID. We fully intend and expect to have these hotels sold by the summer of 2026.

Q. Are there different classes of shares being offered?

A. Every investor is a preferred investor.

Q. Are you investing your own money in these projects?

A. Yes, everyone in the corporate office has their own money invested.

Q. I have an IRA with Fidelity. Does Fidelity handle money for you?

A. Fidelity has additional restrictions when it comes to investing in Alternative Investments. You would need to have $1,000,000 or more in traditional assets invested with Fidelity in order to invest with a Fidelity Self-Directed IRA.

Q. Will we have the option to buy one of these properties ourselves?

A. Yes. If you want to buy one of our properties when they go on sale in 3 years, you are more than welcome to buy one.

Q. If monthly dividends from my REIT IRA with your company are deposited into my personal account, isn’t that considered cap gains and early withdrawal?

A. For all IRA investments we send the monthly distributions back into your IRA account, as to not trigger any taxable events. You can then withdraw the distribution payment from your IRA custodian whenever you would like.

Q. Is the future maintenance and property management hotel cost built into the ROI models or the 12% annual?

A. Yes, we have paid 12.04% after all expenses and fees had been paid.

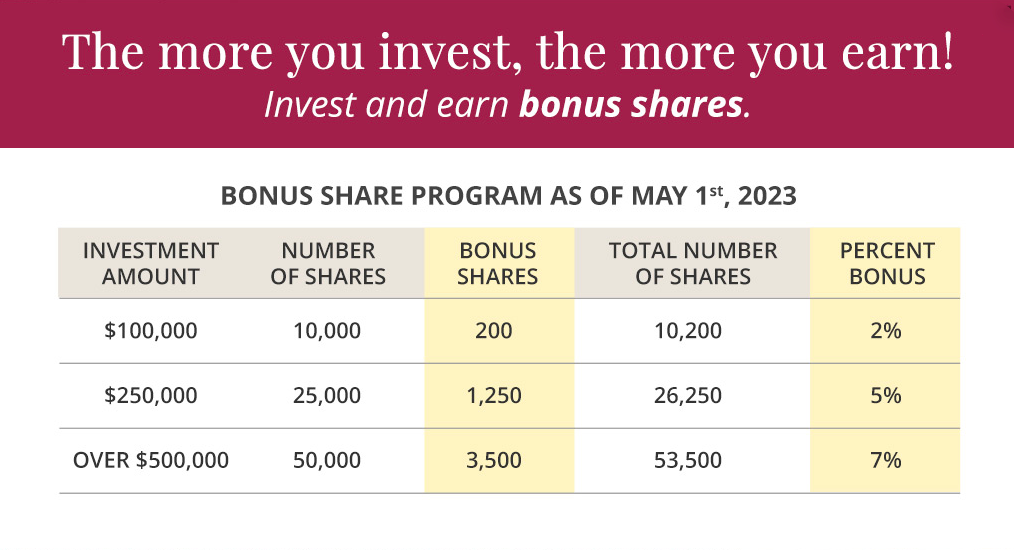

Q. Looking at your website, it says there is a bonus for larger investments. Is that included in your anticipated return?

A. Yes, your ROI is calculated based on the shares you purchase as well as the bonus shares you earn by making a larger investment.