Q&A from the Webinar:

Q: If you make more money, is it possible we will receive more than 8% in that year?

A: The answer is an absolute YES!

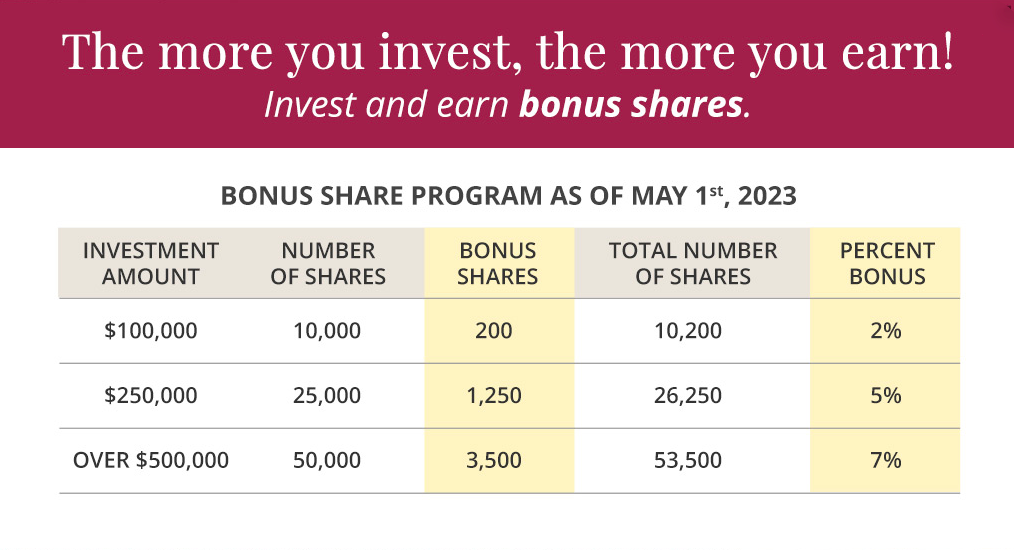

The Securities and Exchange Commission (SEC) has set out the guidelines for the 90% rule for REITs: “To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90% of its taxable income to shareholders annually in the form of dividends.” But in addition to that, the Investor should expect capital gain once we sell the assets. AND, if they take advantage of our “bonus shares” program, a significant amount of capital gain could be “locked in.”

Q: How and when do you anticipate the growth aspect getting paid? Will you hold all your hotels and sell them in the same week?

A: We anticipate selling our properties within 3–5 years of acquiring the portfolio. Through our active management, we plan to improve the cash flow and valuations of our hotels, so that when we do sell them, it’ll be for a profit.

Q: If you sell sooner than 3–5 years, will you buy another hotel or distribute that money?

A: No, we will not buy another hotel. Our offering documents as filed with the SEC require that any proceeds for sale be returned to the Investors.