Buying low, selling high, and banking dividends along the way isn’t just for Warren Buffet.

Our strategy is simple. Buy Premium Business Select Hotels now, while they’re at COVID-depressed prices. Run them, while improving profits, then sell them when the hotels return to “full market” value.

INVEST NOW - In USD or Cryptocurrency*

Please read the Offering Circular before investing.

ABOUT US

Many investors are seeking monthly income (and growth along with it).

As an asset class, real estate offers a number of compelling benefits, including regular income, capital appreciation (growth of your original investment) potential, and diversification, but not all parts of the real estate market perform alike. Now, as the economy emerges from COVID-19 and growth heats up, hotels—and particularly business select hotels—may offer some of the strongest growth potential of any real estate sector.

Up to now, all the benefits of hotel real estate investing—including capital preservation, income, and long-term capital appreciation—have primarily been available to institutions and very wealthy people through private investment partnerships and private equity real estate funds with large minimums.

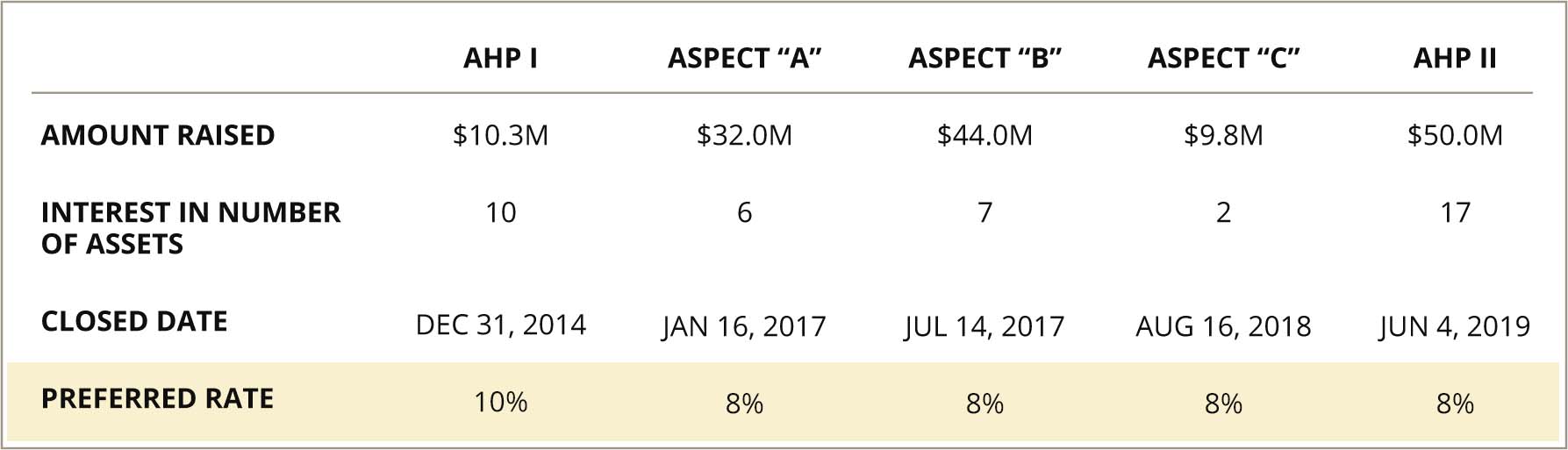

American Hospitality Properties REIT, Inc. should know—that’s how we ran our first few funds.

Now, this opportunity is open to everyone!

Our goal is to offer investors the opportunity to invest in professionally managed, focused commercial real estate with an institutionally experienced manager. We aim to provide substantial income, reduce your overall portfolio volatility (and spread your dollars across several investments in the sector), diversify risk (via capital preservation by investing in a “real” asset), and contribute to your mid-term growth (within five years).

Returns are not guaranteed, and there is no guarantee that objectives will be met.

Here’s what you need to know to understand if this is for you:

Why Phoenix

Why consider American Hospitality Properties REIT, Inc.?

Our goal is an 8% preferred return. We’ve already beaten it:

We have already distributed to our REIT Investors an annualized 12.7% return for the six (6) months ending 3/31/22. Why the difference? As a REIT we are required to distribute 90% of our profits. The 8% is our asurance of a “preferred return,” meaning you get paid first. We we will not receive compensation until that return is met.

We are expecting higher monthly returns riding the travel rebound of 2022.

As in all investments, returns are not guaranteed, and there is no assurance that objectives will be met.

Strong growth potential:

In addition to planned monthly distributions, investors are scheduled to share in the profits (if all goes according to plan) of hotel values. We aim to sell our hotels in 3-4 years at full market rates, reflecting the value we bring from buying at COVID-reduced rates, and from our improvements to operations and facilities.

Our goal is to achieve a strong IRR (internal rate of return), including both distributions and growth, for our investors. Our investors earn 100% of the first 8% of returns. When—and only when—we outperform this hurdle, we begin to share in the profits.

Since we only get paid after our investors have made the first 8%, we sit on the same side of the table as you. This means that we have every incentive to increase profits. Not only that, we are personally invested in this REIT with the exact same terms as you.

All three of our prior offerings have exceeded their target returns. Please reach out to us for full details.

Profit Distribution

| Returns | 8% | 8-12% | 12%+ |

| Investors Receive | 100% | 80% | 60%+ |

Our goal: return of capital within 3-5 years:

Based on the current environment, Phoenix expects to liquidate its investments (sell hotels) within three to five years. There is no reinvestment of capital. Assuming we meet our time horizon goal, investors can expect to receive their initial investment, plus or minus appreciation, within five years.

There is no guarantee that this objective will be met.

The same opportunities that institutions and wealthy families have long enjoyed:

The world’s wealthiest, most sophisticated investors have always had access to top-quality, professionally managed commercial real estate investments in this high-potential sector of the market. Now you can invest in real estate too without all the wealth requirements.

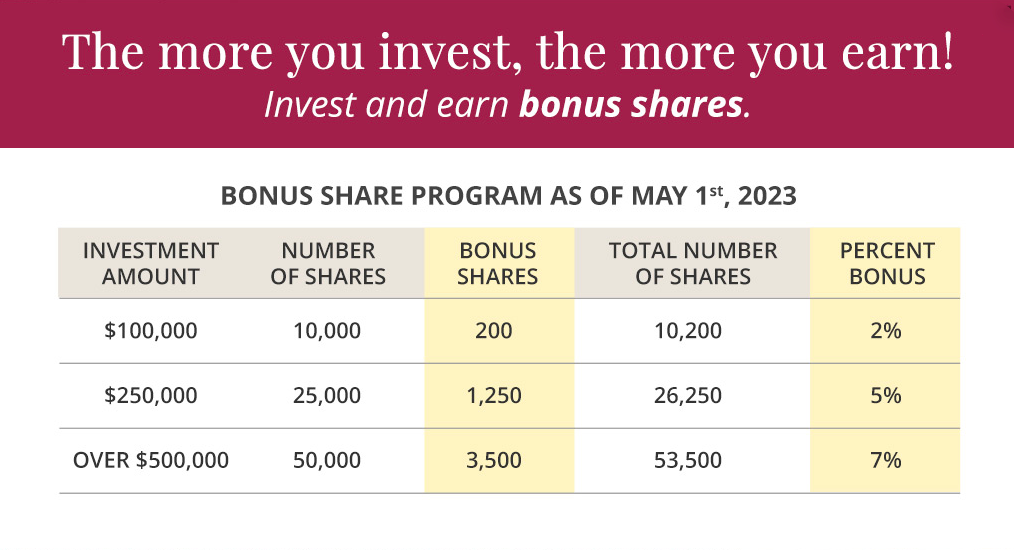

Open to ALL investors:

Our Reg A+ offering empowers investors of all income levels and portfolio sizes to invest, subject to certain dollar amount limitations on common stock that may be acquired (as described in the Offering Circular). You do not have to meet accreditation hurdles to qualify.

OUR SEC-QUALIFIED OFFERING

$50 million

Winston & Strawn LLP

KoreConX

Grant Thornton

Who should consider American Hospitality Properties REIT, Inc.?

- Investors who are seeking income and appreciation potential

- Investors looking for a hedge against inflation

- Investors who can afford to tie up capital for three to five years

- Investors with self-directed IRAs (or you can open one with our partner!)

THE PHOENIX ADVANTAGE

SPECIALIZED EXPERTISE, HANDS-ON KNOWLEDGE, DECADES OF EXPERIENCE, AND 100% FOCUS.

Here are seven reasons to choose Phoenix when you take advantage of this focused hotel opportunity.

This isn’t our first rodeo

Phoenix has been successfully and profitably investing in the hotel sector since 2009, through good markets and bad. Our current fund offering is our firm’s fourth—and all three previous funds met or exceeded investor expectations for income and capital appreciation. Beyond that, our team boasts decades of experience in the hotel business.

We’re owners AND operators

Most hospitality acquisition firms focus on acquisition and outsource management, investing up and down the full-service continuum with varied fixed and variable costs.

Phoenix focuses on strongly branded (e.g. Marriott, Hilton, and Hyatt) business select hotels. For Phoenix, these hotels aren’t just real estate investments—they’re investments in operational effectiveness. We aim to take well-running properties to the next level in terms of revenue generation, quality, association engagement, and ownership returns.

We know what makes hotel investments successful

Our investment process identifies what we believe to be the properties with the highest potential for success by focusing on six key characteristics:

- Strong national brands: We invest in names you know, like Hilton, Hyatt, and Marriott.

- Proven performance: We seek out properties that are already making money, with strong, positive cash flow.

- Market leadership: We look for hotels that are outperforming their competition.

- Location: Our focus is on urban markets with a business travel focus.

- Multiple revenue sources: We look for hotels with occupants looking to be near businesses, hospitals, and colleges, to name a few of the types of frequent guests we seek.

- Price: We purchase properties priced below what a new hotel would cost.

We focus on one of the most resilient segments of the hotel market

Even within the hotel sector, some properties are better positioned than others. The three main hotel types are luxury, business select, and budget. Business select hotels provide more amenities than budget hotels. They will typically offer small meeting spaces and a limited-service restaurant. They offer fewer amenities than luxury properties. You typically won’t find a concierge, a bellhop, a spa, or room service at a business select property.

Business select hotels appeal to a broad array of customers, including road-warrior and regional business travelers, small business owners, and middle-class leisure travelers, who are primarily making domestic trips. These properties are attractive in nearly all market climates, offering the highest operating and profit margins in the industry, but they are especially resilient during downturns. This middle category experienced less of a drop-off in demand during the pandemic crisis, and it’s expected to rebound more rapidly than budget hotels.

We can put money to work immediately

We are continually evaluating new properties that meet our criteria, and because we are in the thick of hotel industry deal flow, we can put new money to work quickly—often within 30 days. That allows our team to take advantage of fast-moving opportunities in changing markets.

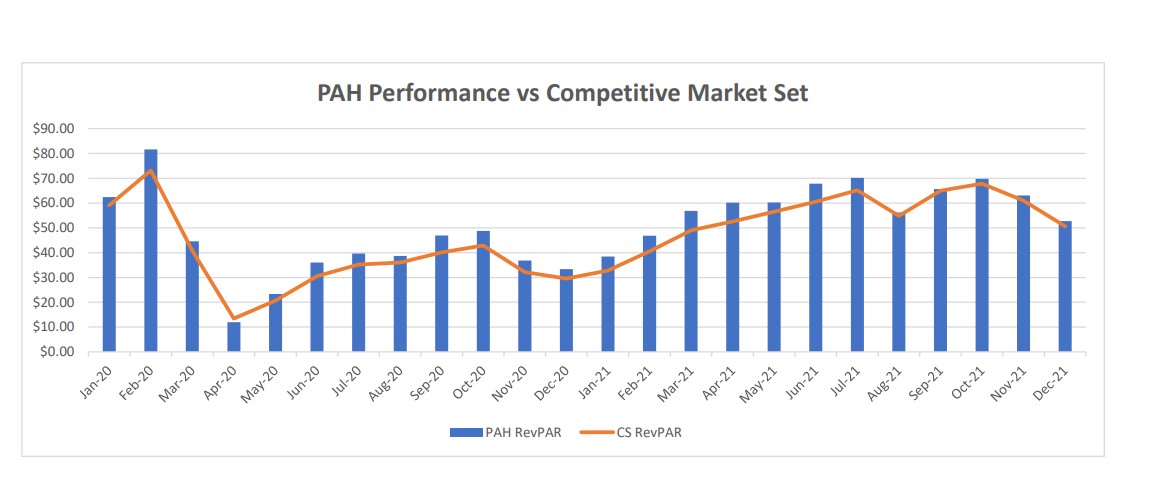

We understand how to boost performance

We buy good properties and make them great, increasing profitability through cost-cutting (not just labor), dynamic pricing, property upgrades, and targeted sales campaigns. The proof is in our results: since the global pandemic began, the Phoenix portfolio has consistently surpassed those of competing hotel investment sponsors. In arguably the worst period in American hotel history—the COVID-19 crisis—we outperformed our peers each and every month, without fail.

In 2020, we continued to pay distributions—even in the most challenging markets

As the COVID-19 pandemic swept through the travel business, several hotel-focused investment funds immediately suspended distributions. Phoenix has been able to pay distributions in four of the last six periods to date, including at year-end 2020, because of our commitment to shareholders and our focus on reducing risk. We manage risk through a variety of mechanisms:

- Purchasing already-performing hotels at prices below replacement value

- Investing in the relatively resilient business select sector rather than in luxury or budget

- Maintaining reserves for adverse circumstances

- Avoiding investment in America’s largest cities, which suffered the biggest losses during COVID-19

Past performance is no guarantee of future returns.

DOWNLOAD OUR INVESTMENT GUIDE

Invest alongside major institutions in one of commercial real estate�s most compelling sectors: Business Select Hotels.

PRESS

PHOENIX FUNDS IN THE MEDIA

Our innovative strategy has attracted the financial media’s attention. Here’s recent news coverage of Phoenix Funds.

OUR TEAM

EXPERIENCE AND SPECIALIZED KNOWLEDGE

Our team has decades of hands-on experience profitably buying, owning, and managing hotel properties. Here are our senior management leaders.

INVEST NOW

PRICES ARE STILL ATTRACTIVE —

THE TIME TO INVEST IS NOW

The pandemic depressed hotel prices across the board, creating some attractive investment opportunities for agile investors. But as travel resumes, values will almost surely rise. We believe that we are now facing a major opportunity, where lower-than-usual prices converge with the potential for extraordinary growth. But the time to invest is now—and now, through Phoenix American Hospitality, that opportunity is available to investors of all types and account sizes.